We had some plans to do this by extending smart rules. For example, put in housing anything above X with this reference. We have not had the time to put this in the pipeline. ![]()

I really want all of this too ![]()

This is also a great way of convincing friends, family etc to onboard to Emma.

This is true! definitely could make the app more attractive to frineds and family!

We need to be able to print statements of our investment and savings pots to be able to show proof of funds.

Pots statements are sent once a year before the end of the fiscal year. We are working to make Emma Invest statements available through the app.

Hi! I love the split transactions feature! There’s an improvement that I think can make a world of difference for me. If there’s a convenience button of

“Split monthly”

→ choose number of months

→ choose start date

→ automatically splits the transaction equally across number of months with the same date for each month.

This would help me

- split my annual subscriptions across 12 months much faster

- split any purchases I make split across months to easily budget

- I often do gym payments once every 3 months in advance, so splitting a transaction into a custom number of months but set the start date in the future would be nice.

Eg. It’s August 20th, and I pay my gym membership for Sep, Oct, Nov on Aug 20. I’d like to be able to:

Split into 3 months, start on Sep 20.

Thanks! Really love the customer service and the app!

Hey! This is a fantastic idea thanks for letting us know! I think there are a bunch of other users who must be doing the same and would agree that this function would be really beneficial for them! We’ll look into integrating that!

Not just net worth longer than a year. Would be nice to have all graphs longer than a I year as I’ve been using Emma since 2017 but can only see 1 rolling year of progress ![]()

Yes, we have decided not to do it. There are few challenges in extending the graphs that doesn’t make it worth it at this point. Banks also return different periods so graphs are not going to be working well. ![]()

I’d really like to be able to share pots with my partner in the same way that I can share a space with him. At the moment only one of us can see our household pots for various things we like to set aside money for - Christmas, holidays, kids birthdays etc. If both of us can see and control the pots it would really help for us both to keep a track of our family finances and make decisions about our other expenditure quickly. I think it would be a helpful feature that would support many busy couples and families who like to take equal responsibility and control of their household finances. The ability to share spaces only goes some way to addressing that need.

Yes, for this we wanted to do share pots, which are a bit different from spaces, so that both partners can deposit. A bit like a joint account.

The alternative is to make them count in spaces, but the other partner wouldn’t have the ability to deposit.

Had a separate thread for this but reuploading on this to get more viewing:

Step by step details of what this feature would do:

When you recieve you income it would automatically transfer this to a nominated savings account of customers choice.

From this savings account (prefereably chase as this is the only bank which allows savings accounts to have standing orders, as far as I am aware), it would automatically transfer the budgets for your bills when required each week/month/year depending on the frequency of the bills, to the account the bill we paid from.

From this savings account, it would automatically transfer your weekly/monthly budget to a nominated current account.

The above is the basis at which I have budgeted myself previously, and believe this a great way to ensure all bills are paid on time and sticking to your budgets on a weekly/monthly basis.

This method will also pay interest to unused income untill it is used, making the most of the interest of savings account.

Hi!

Would it be possible to show totals for excluded transactions as well?

For example:

- Exclude transaction A

- Add tag # stuff to transaction A

Now I want to be able to search for # stuff and see the totals for it including the excluded transaction. Maybe it’s a filter option?

Thanks!

Varun

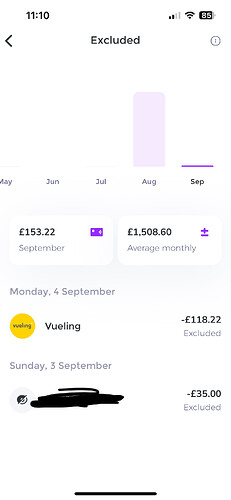

Have you tried checking Analytics?

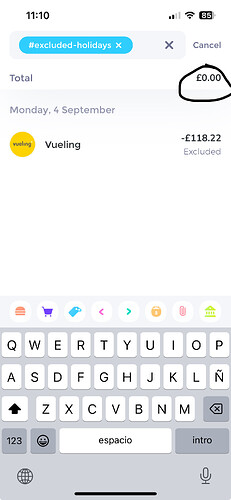

Ah so what I want is a subset of excluded

I know we can see excluded totals here

I would like to see exactly the excluded totals WITH a specific tag

Let me know if that makes sense!

This makes it easier to go along and tag and exclude things that I pay for but know I will get reimbursed in the future. But makes it easy to see the total amount I need to get reimbursed.

Thanks!

Yes, thanks a lot for reporting this, we can take a look. ![]()

Committed Spend Total

It would be really useful to look at the committed spend total (recurring payments) per month to assist with month by month budgeting

I would like to know which transactions I have not seen yet:

Workflow:

- Every night I go through recent transactions to categorise etc

- Sometimes pending transactions are committed to dates previous than what I have previously gone through

- I also dont remember if I have gone through all the transactions i’m looking at

I would like to have a toggle: “See unseen transactions”

So I can quickly go through and categorise newly committed transactions.

Let me know if that makes sense!

Hi - is it possible to include a feature which enables you to select individual budget categories to roll every month - rather than one button which covers all?

Also - would love the possibility to roll negatively too - ie if you overspend in a category one month, then the budget available reduces the following month (or is spread over your selected number of months)[quote=“edoardomoreni, post:82, topic:6046, full:true”]

I think some people might appreciate this change in “unbudgeted spend”. ![]()

[/quote]

The issue we saw with this was that it would break the total budget eventually. If you keep them rolling.