Do you get interest?

Starling currently pays 0.05% on personal accounts up to 85k. Spaces are included in your account balance (not like monzo).

Yeah, but it’s till £2k no?

I am talking about 0.40% or 0.60%.

This makes a lot of sense.

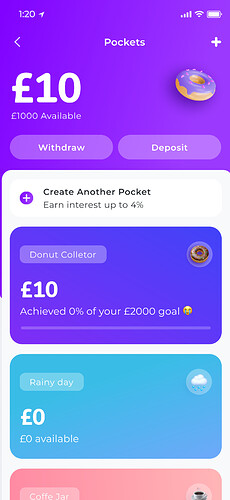

Yeah Vaults are for savings whatever that maybe for. And every month right after payday all my ‘Pockets’ fill up every month, eg mortgages, car finance, insurance, all go into separate Pockets and fill up every month so I know all these expenses will be covered and I don’t accidentally spend it. It’s a game changer for me. You could set them up for each budgeting category but I prefer to set a different Pocket for each exact expense they are easy to setup. Well it depends I guess, I have buildings insurance monthly payments for 2 properties coming out of the same Pocket.

Ok cool, this is good to know!

Do you know if there is a maximum amount of pockets you can create?

as far as I am aware no I have around 15 Pockets and 20 vaults

Screenshot mentions “earn interest up to 4%”

Any news to share on that?

Keep dreaming! The mockup lies

Sorry yes! We’re going to start without interest and will introduce this later on so will share specifics then

ahahahahah

We can defo provide 4% but it would be without FSCS protection, on a Crypto Stablecoin and very unsafe. eheh

Firstly, roundups. Literally the only reason I have moneybox.

Secondly I do actually quite like the fact that moneybox autoinvests in funds or pensions but it would be cool to see a crypto one.

Yep, we are going to add this too. ![]()

I don’t know if this would be impossible or if you are planning something like this already. But once you have pots with interest would you set up the ability to do an automatic withdrawal based on bank balances and a chosen criteria (ie a specific day or if an account is overdrawn)?

Hey @Kieran1

This sounds like a cool idea - would you want to set up automatic transfers in and out of pots?

E.g on payday move X into a pot, but then move X out of a pot if the current account balance was below X?

Hi Rebekah and exactly, at the moment I put as much of my wage as possible into chip for the interest and use a free overdraft for my weekly spends, once chip calculates the interest I try to remember to cover the overdraft.

A smart rule to do this would be great and stop me forgetting to move the money, going over the free overdraft limit and getting charged

Ok awesome, that makes sense!

We just need to finish working on the feature that’ll let you transfer money between your own accounts first